In this Charity Charge Show episode, CEO Karen Houghton explains how Infinite Giving helps nonprofits receive and manage non-cash donations, build reserves, and pursue endowments with fiduciary oversight. She shares lessons from leading a nonprofit, working in venture capital, and serving on boards, and offers practical steps any organization can use to move from scarcity to strategy and, ultimately, sustainability.

About Karen

Karen Houghton is CEO of Infinite Giving. She previously served as an executive director, spent a decade in tech and venture capital, and serves on boards ranging from small nonprofits to institutions with multi-billion-dollar endowments. She holds a Series 65 and leads Infinite Giving’s work across 41 states.

New resource: Karen’s book, Funding Your Mission: A Modern Guide to Nonprofit Finance, is slated for late November to early December. It focuses on nonprofit-specific finance practices, donor trends, and data from hundreds of organizations.

Episode at a glance

-

Guest: Karen Houghton, CEO, Infinite Giving

-

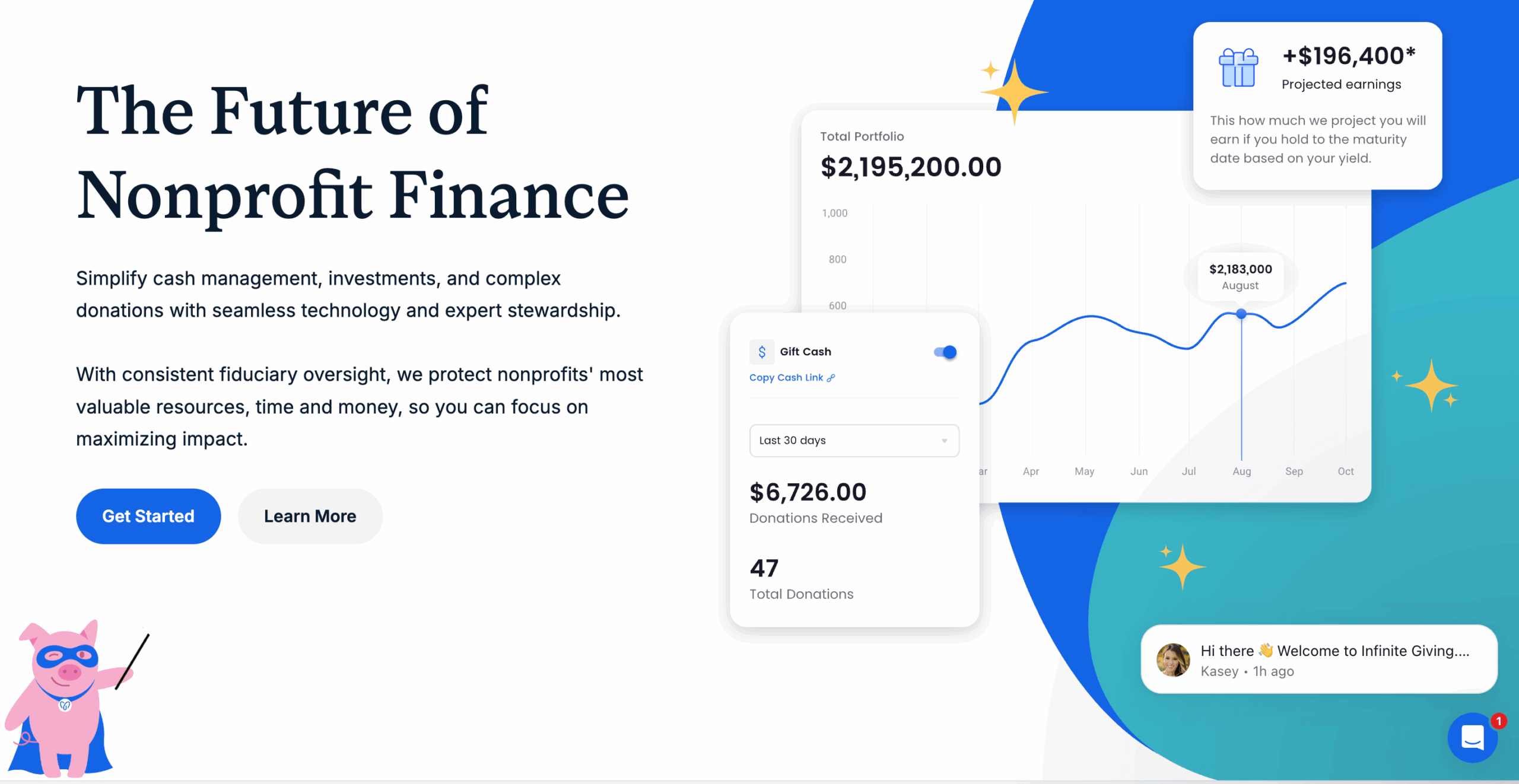

Core idea: Modernize nonprofit finance so organizations can easily accept and manage non-cash gifts and put money to work responsibly.

-

Why it matters: Ninety percent of donor wealth is held in assets, not cash. If you only ask for cash, you are missing major gifts.

-

Key numbers from the show:

-

Stock giving up 136% over eight years

-

Nonprofits that actively pursue stock gifts raise 55% more

-

Average online cash gift: $128 vs. average stock gift: $8,000

-

Why nonprofit finance feels harder than it should

Karen notes the U.S. financial system was built for retail and commercial clients, not tax-exempt entities. That mismatch creates friction for nonprofits:

-

Brokerage accounts can take weeks to open and are often set up poorly for gift intake.

-

Donor names do not automatically attach to stock transfers.

-

Changing authorized users or accessing FDIC sweep programs is slow and paperwork heavy.

-

Many leaders lack a clear playbook for reserves, liquidity, and endowments.

Infinite Giving’s approach: act as a single fiduciary partner that helps nonprofits receive, manage, and grow non-cash gifts with fast brokerage onboarding, automated receipting and liquidation, and clear reporting for staff and boards.

Three trends every nonprofit finance leader should act on

1) Move “beyond the bank” for operating reserves

Checking and basic savings accounts are not designed for multi-month reserves or multi-year campaign funds. Karen recommends segmenting cash by purpose and time horizon, then using appropriate vehicles. Examples discussed on the show include:

-

Capital preservation and short-duration options for near-term needs

-

Treasury and fixed-income portfolios for planned spend in 6–36 months

-

Clear liquidity rules and board-approved policies

2) Bring endowments into reach

Endowments are no longer limited to large universities. Smaller organizations can use unrestricted, designated, quasi, or term endowments to match donor intent with organizational flexibility. A common target Karen sees: a $10M endowment that can distribute roughly $500k per year when managed with prudent payout and risk controls.

3) Make non-cash giving easy

Most donor wealth sits in securities and real estate. If your website only promotes credit cards and checks, you are limiting the size of gifts you can receive. Infinite Giving helps nonprofits:

-

Open a brokerage account quickly, with no minimums

-

Receive stock and crypto gifts with no transaction fee on stock gifts

-

Automate liquidation, receipting, and reporting to reduce staff burden

From scarcity to strategy: a simple playbook

-

Map your money by purpose. Separate operating cash, reserves, campaigns, and endowments.

-

Write the policy. Create board-approved guidelines for liquidity, risk, rebalancing, and withdrawals.

-

Open the right doors. Stand up a brokerage account and publish a one-page “How to Give Stock” guide with DTC and account details.

-

Promote asset gifts. Add “Give stock or crypto” to your main donate page and gift acknowledgments. Train gift officers to ask.

-

Right-size your reserve strategy. Place near-term funds in capital-preserving vehicles. Use time-bound portfolios for multi-year spend.

-

Plan your endowment path. Decide between unrestricted, designated, quasi, or term. Align payout rate with board policy and mission needs.

-

Report like a winner. Provide quarterly board packets that show performance, fees, liquidity, and impact to build trust with donors.

A typical client journey (as described on the show)

-

Start: A nonprofit comes in with cash locked in low-yield accounts and an outdated stock-gift process.

-

Setup: Infinite Giving opens a brokerage account in about three business days with roughly 30 minutes of staff time.

-

Streamline: Stock and crypto gifts settle, auto-liquidate, and move to the right buckets. Donors receive timely receipts.

-

Grow: The organization adopts board policies, segments reserves, and launches an endowment or quasi-endowment.

-

Support: Infinite Giving provides quarterly board reporting, joins meetings as needed, and adjusts portfolios to match policy and time horizon.

Practical checklist to implement this week

-

Add “Give stock” to your main Donate page with clear steps.

-

Open a brokerage account tied to your nonprofit, not a pass-through.

-

Draft a Board Investment Policy Statement that defines liquidity needs and risk ranges.

-

Identify three donors likely to give appreciated assets. Ask for a stock gift on your next call.

-

Prepare a one-page endowment brief outlining options and payout policy.

Podcast Q&A Transcript

Grayson Harris: For those who don’t know you yet, what does Infinite Giving do for nonprofits?

Karen Houghton: We’re a fiduciary partner for growing nonprofits. In one place, we help you receive non-cash gifts (like stock and crypto), manage those assets with clear policies and reporting, and grow them responsibly—so leaders can focus on mission, not financial friction.

Grayson: What inspired you to start Infinite Giving?

Karen: I was an executive director of a small nonprofit. I filed the 501(c)(3), fundraised, worked with boards—and realized finance wasn’t my strongest area. More importantly, I learned the U.S. financial system wasn’t built for tax-exempt organizations. It predates the very idea of tax exemption, so nonprofits hit frictions that families and businesses don’t.

Grayson: What kinds of frictions are you talking about?

Karen:

-

Opening a brokerage account can take weeks.

-

Donor names don’t attach to stock transfers by default.

-

Changing authorized users on financial accounts can be paperwork-heavy.

-

Access to FDIC sweep programs and the right liquidity tools isn’t straightforward.

These are solvable problems—but nonprofits need partners who understand their compliance and stewardship needs.

Grayson: How does Infinite Giving actually remove those frictions?

Karen: We built a nonprofit-first workflow:

-

Fast brokerage onboarding: ~30 minutes of your time; about three business days to open.

-

Non-cash giving made easy: Stock and crypto gifts flow in with automated receipting, liquidation, and board-ready reporting.

-

Right-fit portfolios: Clear options for operating reserves, time-bound funds, and endowments—aligned to board policy and liquidity needs.

We now serve hundreds of nonprofits in 41 states.

Grayson: Your background spans nonprofits, tech, venture, and boards. How does that shape your approach?

Karen: I’ve sat in all the seats: fundraiser, ED, board member for small orgs and institutions with multi-billion-dollar endowments, and I hold a Series 65. The pain points are remarkably similar across sizes. That perspective helps us blend traditional fiduciary rigor with modern, nonprofit-friendly operations.

Grayson: You talk about moving from scarcity to strategy. What does that look like in practice?

Karen: Strategy means:

-

Segmenting cash by purpose (operating, reserves, campaigns, endowment).

-

Creating board-approved policies for liquidity, risk, and withdrawals.

-

Using fit-for-purpose vehicles (capital preservation for near-term, short-duration fixed income for 6–36 months, diversified portfolios for longer).

When you normalize this planning, you build sustainability—the ability to keep serving even when a gift falls through or conditions change.

Grayson: What trends are you seeing that nonprofit finance leaders should act on now?

Karen: Three, consistently:

-

Beyond the bank: Checking/savings are for operations—not multi-month reserves or multi-year campaign funds.

-

Endowments for more orgs: Not just higher ed anymore. Quasi, term, designated, or unrestricted endowments are increasingly accessible and fundable. (A common vision we see: a $10M endowment targeting about $500k in annual support under prudent policy.)

-

Asset gifts are rising:

-

Stock giving up 136% over eight years.

-

Orgs that actively pursue stock gifts raise 55% more.

-

Average online cash gift ≈ $128 vs. average stock gift ≈ $8,000.

If you only ask for cash, you’re asking donors for their smallest bucket of wealth. Most donor wealth is in securities and real estate.

-

Grayson: Many orgs say, “We don’t get stock gifts.” What are they missing?

Karen: Usually infrastructure and visibility. If giving stock requires a PDF download, phone calls, and manual follow-ups, donors won’t bother. Give them a clear, fast path: open the brokerage account, publish “How to Give Stock” details, and ask in campaigns. Our platform takes no transaction fee on stock gifts, and we handle receipting, liquidation, and transfers so staff aren’t chasing details.

Grayson: Can you give a typical client journey?

Karen: Sure:

-

Start: Org has cash stuck in low-yield accounts and a manual stock-gift process.

-

Setup: Brokerage opened in ~3 business days; staff invests ~30 minutes.

-

Streamline: Stock/crypto gifts auto-liquidate and route to the right buckets; donors get timely receipts.

-

Mature: The board adopts an Investment Policy Statement; reserves and campaigns are aligned to time horizons; an endowment or quasi-endowment launches.

-

Support: Quarterly board reporting, participation in board meetings when helpful, and ongoing policy-aligned management.

Grayson: Any recent examples that surprised even your team?

Karen: We regularly process seven-figure stock flows across clients, and even crypto—we just processed a $330,000 crypto gift before this conversation. Crypto is an outlier, but it proves the point: if you remove friction and publish the path, generous gifts follow.

Grayson: Final question—what’s next for Infinite Giving?

Karen: Welcoming more nonprofit leaders to the platform—and my book, Funding Your Mission: A Modern Guide to Nonprofit Finance, arriving late November/early December. It’s written for boards, finance teams, and executives who want a nonprofit-specific playbook, plus data from the hundreds of organizations we serve.

Grayson: Where can listeners find you and the book?

Karen: Visit our website for onboarding and book updates, and you’ll also find it on major booksellers once it’s live. We’d love to meet you and help you build a simpler, stronger financial stack for your mission.