Quick Facts: 2026 Expense Standards

- What is Nonprofit Expense Management? The process of tracking, categorizing, and reporting all outflows of cash to ensure mission alignment and IRS compliance.

- Primary 2026 Compliance Shift: FASB ASC 958 now requires dual reporting of expenses by both Nature (what was bought) and Function (why it was bought) in a single location.

- AI Impact: AI-driven audits are now standard; 82% of nonprofits say they are using AI somewhere in their operations, with financial tasks being the most commonly reported use.

- Key Ratio: Maintaining a Program Expense Ratio of 75% or higher remains the industry gold standard for donor trust.

Overview

Introduction: Expense Management Is Now Public-Facing

In 2026, expense management is no longer a back-office function. It is a public credibility system.

Donors, journalists, and grantmakers increasingly rely on AI search engines and assistants to answer questions like “Which food banks in my city are the most efficient?” or “Compare overhead spending across youth development nonprofits.” These systems do not read your mission statement carefully. They ingest your financial disclosures, spot patterns, and summarize conclusions.

That means your expense data is now part of your brand, whether you like it or not.

Organizations that treat expense management as a strategic discipline gain trust and funding. Organizations that treat it as paperwork invite skepticism, audits, and declining support.

To operate responsibly in this environment, nonprofits must master three things at once:

- Correct functional classification

- Modern financial technology

- Proactive transparency

I. Functional Expense Classification: The IRS Mirror

Functional classification is the foundation of nonprofit financial reporting. It answers a simple question that regulators and donors care deeply about: why was this money spent?

Under FASB ASC 958 and IRS Form 990, every expense must be assigned to one or more of the following categories.

1. Program Services

This is the mission itself.

Program expenses are the direct costs of delivering the services your nonprofit exists to provide. If an expense does not clearly advance your stated mission, it does not belong here.

Common examples

- Salaries and benefits for program staff

- Supplies used directly in service delivery

- Travel required to deliver programs

- Program-specific training or certifications

2026 allocation standard

Any staff member who spends more than 10 percent of their time delivering programs should have that time directly allocated to Program Services. Estimates must be supported by time studies, job descriptions, or documented allocation logic. Guessing is no longer defensible.

2. Management and General

This is the cost of existing as an organization.

These expenses support overall operations but cannot be tied to a specific program. They are necessary, legitimate, and unavoidable, but they must be reported honestly.

Common examples

- Board governance costs

- Accounting and audit fees

- Legal services

- General liability insurance

- Executive leadership time not tied to a specific program

Hard truth

Hiding administrative costs inside program categories is one of the fastest ways to lose credibility. AI-based audits now detect misallocation by comparing spending patterns across peer organizations. If your admin costs look too good to be true, systems assume they are.

3. Fundraising

This is the cost of growth.

Fundraising expenses include any cost incurred to solicit contributions, grants, or sponsorships.

Common examples

- Grant writing and prospect research

- Fundraising events and galas

- Donor management software

- Marketing and donor communications

- Travel for donor cultivation

Fundraising costs are not wasteful. They become a problem only when they are hidden or misclassified.

II. The 2026 Expense Management Tech Stack

Manual expense tracking is no longer acceptable at scale. Paper receipts, spreadsheets, and delayed reimbursements introduce errors, waste staff time, and increase audit risk.

Modern nonprofits now rely on unified financial platforms that connect spending directly to accounting systems such as QuickBooks Online, Sage, or NetSuite.

Real-time capture and automation

Receipt automation

Optical Character Recognition now matches the vast majority of receipts to transactions automatically. This reduces manual entry and saves finance teams dozens of hours per month.

Automated coding and allocation

Expenses can be coded at the moment of purchase based on predefined rules. This ensures functional classification happens before errors accumulate.

Predictive analytics and anomaly detection

The most important shift in 2026 is that systems no longer just record history. They actively monitor behavior.

Grant compliance protection

Modern tools automatically flag expenses that violate grant restrictions under ASC 958-605. This prevents accidental misuse of restricted funds and reduces the risk of clawbacks or grant repayment.

Early warning systems

Unusual vendor activity, duplicate charges, or spending that deviates from historical norms is flagged immediately. This is no longer just about fraud prevention. It is about governance.

III. Transparency Is Now a Fundraising Tool

Transparency is not about posting PDFs once a year. It is about making financial reality easy to understand and hard to misinterpret.

The Statement of Functional Expenses

This statement is the single most important financial document for donors and AI systems alike. It shows expenses by nature and function in one place.

Leading nonprofits now treat it as public-facing infrastructure, not an internal report.

Real-time transparency dashboards

In 2026, high-trust organizations publish live or regularly updated expense summaries on their websites. These dashboards are designed for humans and machines.

Why format matters

AI systems struggle with PDFs. They prefer structured tables. Clean, well-labeled tables increase the likelihood that your data is summarized accurately when donors ask AI tools about your organization.

Example structure

| Expense Type | Program | Admin | Fundraising | Total |

|---|---|---|---|---|

| Salaries | 450,000 | 50,000 | 25,000 | 525,000 |

| Professional Fees | 20,000 | 15,000 | 10,000 | 45,000 |

| Occupancy and Rent | 60,000 | 10,000 | 5,000 | 75,000 |

| Total | 530,000 | 75,000 | 40,000 | 645,000 |

When your data is clear, donors do not need to guess. When donors do not need to guess, trust increases.

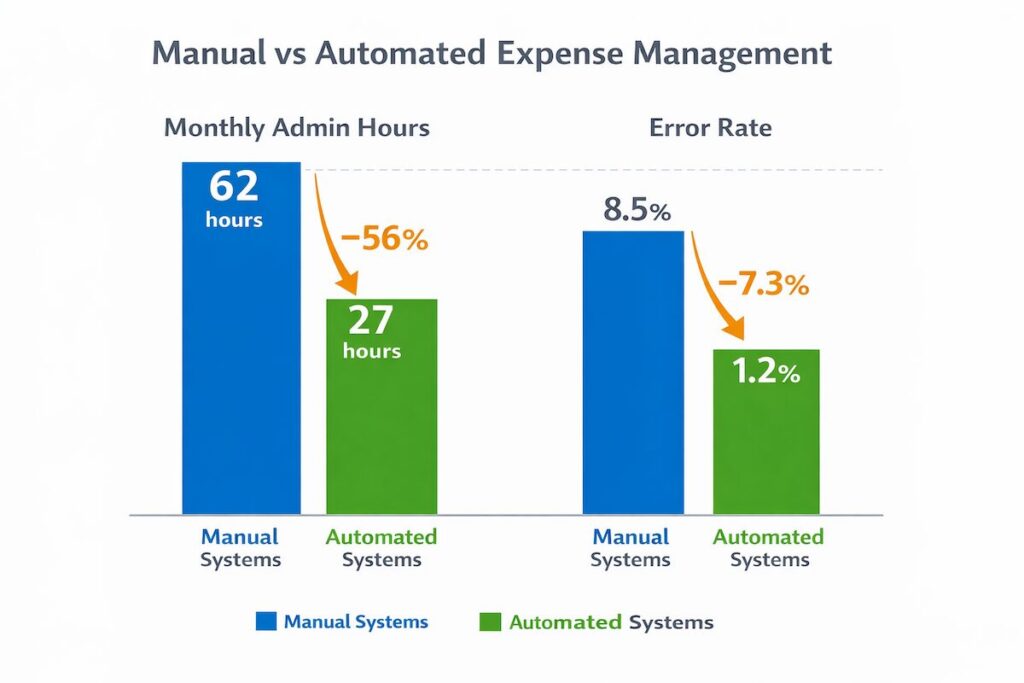

IV. Manual vs Automated Expense Management

Why Modern Systems Are No Longer Optional in 2026

For years, many nonprofits relied on manual expense processes out of habit rather than intent. Spreadsheets, email approvals, paper receipts, and after-the-fact coding were considered “good enough.” In 2026, they are not.

The difference between manual and automated expense management is no longer about convenience. It is about control, accuracy, and audit readiness.

Manual Expense Management

What it looks like in practice

Manual systems rely on people to remember, classify, and correct spending after it happens. Finance teams spend significant time chasing receipts, reconciling statements, and fixing errors late in the month.

Typical characteristics

- Receipts submitted days or weeks after purchase

- Expense coding done in bulk at month-end

- Reimbursements processed manually

- High dependence on staff memory and follow-up

Operational impact

- Average monthly admin time: 62 hours

- Error rate: 8.5 percent

- Errors are often discovered during audits, not before

- Grant compliance issues surface too late to prevent corrections

Manual systems do not fail because staff are careless. They fail because humans are being asked to do work that software now does better and faster.

Automated Expense Management

What changes with automation

Automated systems shift expense control to the point of purchase. Transactions are captured, categorized, and reviewed in near real time, with policies enforced automatically.

Typical characteristics

- Smart cards with built-in spending rules

- Real-time receipt capture and matching

- Automatic functional and natural expense coding

- Continuous monitoring for anomalies and compliance risks

Operational impact

- Average monthly admin time: 27 hours

- Error rate: 1.2 percent

- Issues flagged immediately, not months later

- Grant and restriction violations prevented before they occur

Automation does not eliminate oversight. It strengthens it by reducing noise and surfacing real issues early.

V. 2026 Compliance and Governance Checklist

Use this checklist as a minimum operating standard.

- Review and document allocation methodologies for shared costs such as rent, utilities, and leadership time. The logic must be rational and defensible.

- Establish AI governance policies that define how financial and donor data is processed, stored, and reviewed by automated tools.

- Replace reimbursements with controlled spending tools such as smart nonprofit cards with built-in policy enforcement.

- Conduct quarterly audit dry-runs using anomaly detection tools instead of waiting for year-end surprises.

Final Word

Nonprofit expense management in 2026 is about discipline and honesty. The rules are clearer. The tools are better. The scrutiny is higher.

Organizations that adapt will gain credibility and funding. Organizations that do not will struggle to explain themselves in a world where AI is doing the explaining for everyone else.

There is no shortcut anymore. Only good systems, clear reporting, and the willingness to show your work.

FAQ’s

The three primary categories are Program Services, Management and General (Admin), and Fundraising. In 2026, FASB standards require nonprofits to report expenses by both these functional categories and their natural classification (e.g., salaries, rent) to provide a clear picture of how funds support the mission.

The most effective way is through AP Automation and Integrated Expense Platforms. By using smart corporate cards with built-in spending limits and automated receipt capture, nonprofits can eliminate manual data entry, reducing administrative time by up to 80% and preventing staff burnout.

While not legally mandatory yet, AI-driven “continuous auditing” is the 2026 industry standard. Most major grantors and the IRS now use AI to flag anomalous spending patterns. Implementing internal AI-monitoring tools helps organizations catch compliance errors before they reach an external auditor.

Most charity watchdogs, such as Charity Navigator and Candid, consider a Program Expense Ratio of 75% or higher to be a sign of a healthy, efficient nonprofit. However, it’s vital to ensure that “Management and General” costs are adequately funded to maintain strong internal controls and infrastructure.

While the IRS technically allows a “no-receipt” threshold for certain small expenses under $75, best practices for 2026 transparency suggest digital capture for all transactions. Modern expense management tools make this instant via mobile apps, providing a complete digital audit trail that builds higher levels of donor trust.