In this guide, we’ll explore how charities can utilize Venmo for nonprofits to streamline donations, engage with a wider audience, and ultimately drive their charitable missions forward.

In today’s digital era, charities and nonprofits need to adapt to new methods of financial transactions and engaging with donors. Venmo, a widely used mobile payment app, has become a valuable platform for these organizations, offering them a way to broaden their audience and streamline donations.

This shift reflects the growing trend of integrating technology in fundraising efforts, making it easier for people to support causes they care about through convenient, quick, and familiar digital platforms.

Can you use Venmo for Nonprofits?

Yes, Venmo can be used for nonprofits. Charitable organizations, including those with 501c3 status, can create Venmo profiles specifically designed for nonprofits.

This enables them to receive donations and engage with donors directly through the Venmo app.

To set up a nonprofit profile, the organization needs to have an account and verify its charitable status with PayPal, Venmo’s parent company. This verification grants access to various features tailored to nonprofit needs on Venmo’s platform.

Read our Guide to PayPal for Nonprofits for more features and tools.

Benefits of Using Venmo for Nonprofits

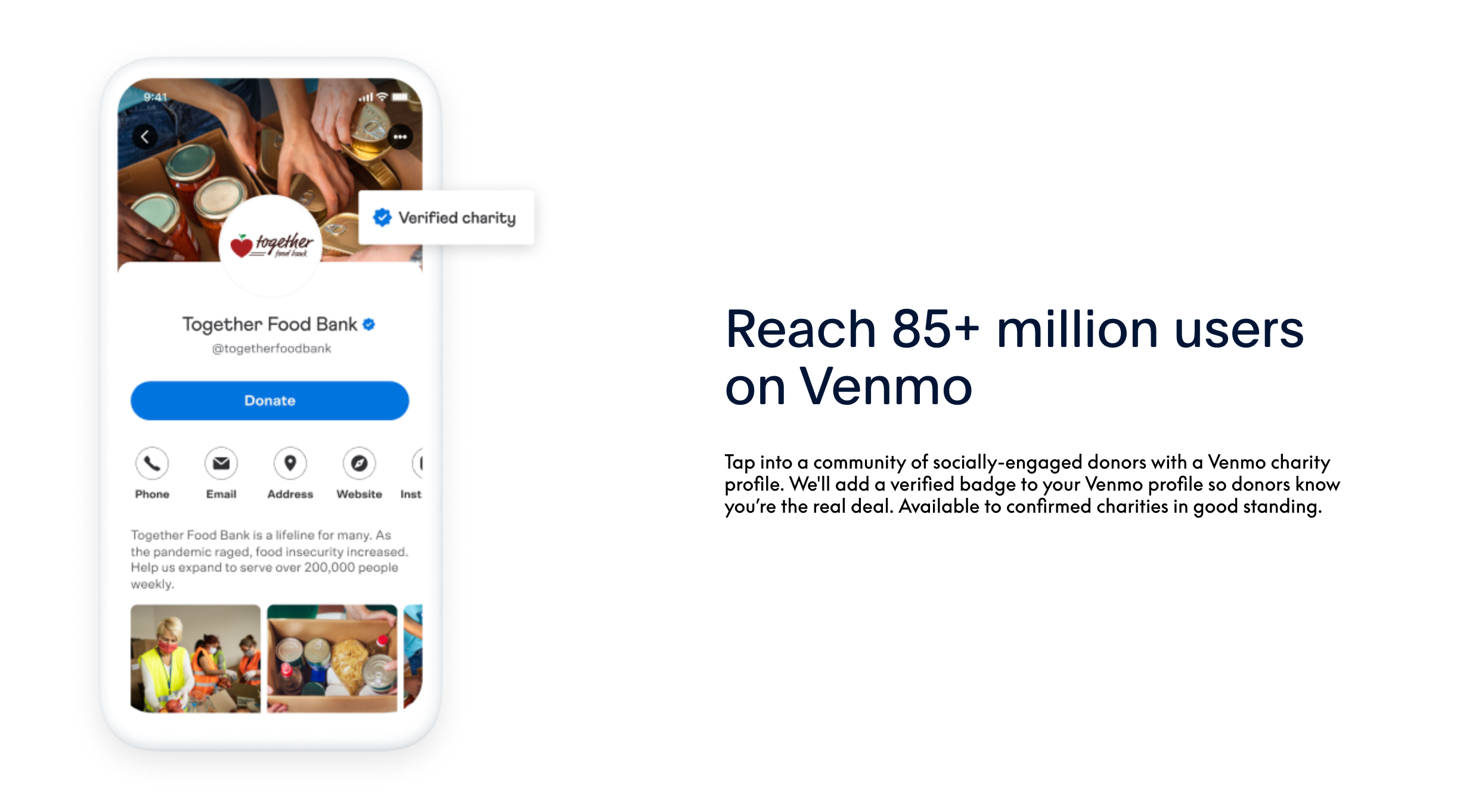

Verified Trust:

The blue checkmark badge on a nonprofit’s Venmo profile instills confidence in donors. This symbol of authenticity confirms the legitimacy of the organization, encouraging trust and credibility among potential contributors.

Enhanced Visibility:

Nonprofits enjoy greater exposure on Venmo. Donor contributions can be shared in their networks, increasing visibility and potentially attracting more donors through social proof and word-of-mouth.

Low Transaction Fees:

The transaction fees on Venmo are competitive, at only 1.9% + $0.10 per donation. This low rate ensures that a larger portion of donations goes directly to the nonprofit’s cause.

Immediate Fund Access:

Nonprofits benefit from same-day access to donated funds, improving cash flow and liquidity. This quick access, although subject to additional fees, enables more efficient operation and financial management.

Donor Engagement Tools:

Venmo offers various tools like photo galleries and QR codes for touch-free donations in person. These features not only facilitate easy giving but also enhance donor engagement by providing a more interactive and convenient donation experience.

These benefits collectively make Venmo a valuable platform for nonprofits seeking to expand their donation channels and engage with a broader donor base.

Nonprofit Bookkeeping and Accounting Services from Charity Charge

Managing finances shouldn’t keep you from your mission. Work with licensed professionals to streamline processes, ensure compliance, and maintain transparency—so your team can focus on what matters most: making an impact. Learn more

Setting Up Your Charity Profile

Initial Steps:

Begin by visiting PayPal’s Business Tools. Here, you’ll find the option to select Venmo, which is the first step in creating your charity’s presence on the platform.

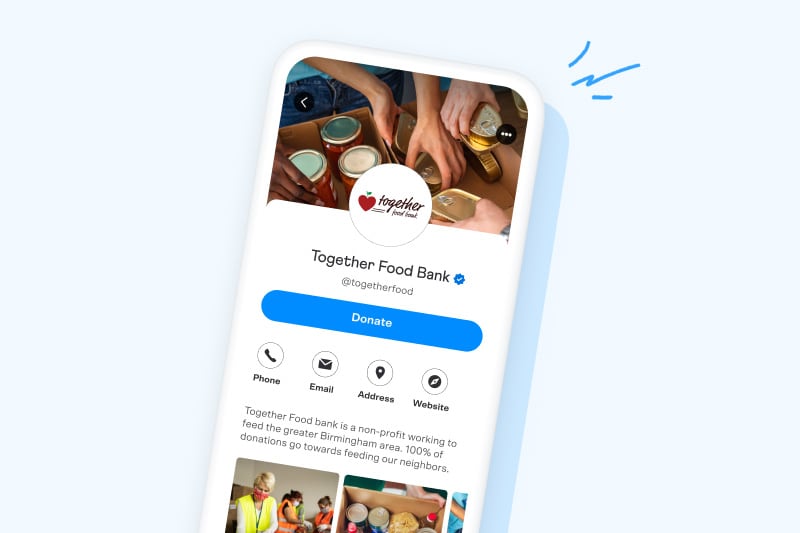

Profile Customization:

This step is crucial for making your charity stand out. You’ll need to provide details such as your charity’s name, a compelling description, and relevant keywords. These elements are essential for making your profile easily discoverable and appealing to potential donors.

Finalize and Publish:

The last step is to review your profile to ensure all information is accurate and reflects your charity’s mission and values. Once you’re satisfied with how your profile looks and the information it conveys, you can publish it, making it visible to Venmo users.

Each step is designed to ensure that your charity’s profile is not only informative but also engaging and in line with your organization’s identity.

Understanding Fees and Transactions

Donation Fees:

For each donation received through Venmo, nonprofits are subject to a fee of 1.9% plus $0.10.

This fee structure aligns with common digital payment processing rates, ensuring that a majority of the donated funds directly support the nonprofit’s cause.

This predictable fee model allows organizations to plan their financial strategies effectively, understanding that a consistent percentage of donations will be allocated to transaction costs.

Fee Structure Example:

When a nonprofit receives a $100 donation through Venmo, a fee of $2.00, which combines a 1.9% transaction rate and a flat $0.10 charge, is subtracted.

Consequently, the charity nets $98.00. This example demonstrates the fee structure’s impact, allowing nonprofits to anticipate the net amount from donations and manage their financial planning accordingly.

Refund Policy:

The fees charged by Venmo for donations are utilized to cover the platform’s operational and development expenses and are not subject to refunds.

This policy emphasizes the need for nonprofits to account for these transaction costs when planning their fundraising activities on Venmo, ensuring they have a clear understanding of the financial implications and can budget effectively for their net donation revenue.

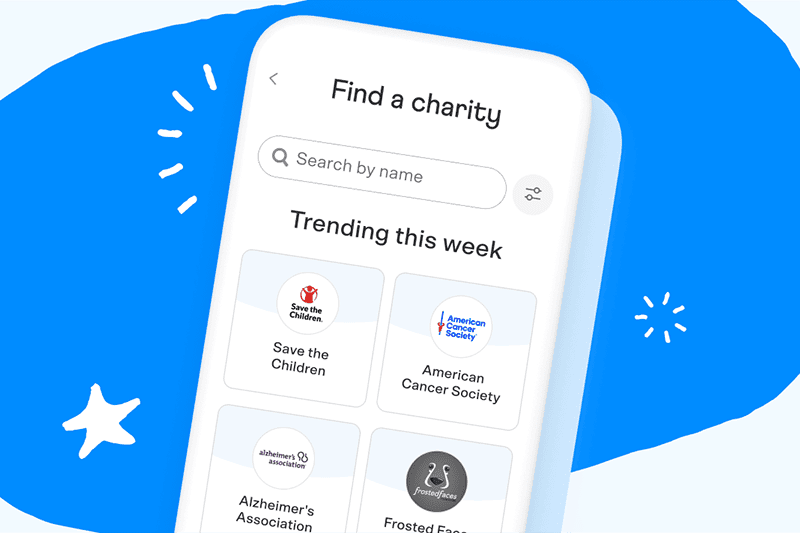

Marketing Your Charity on Venmo

In the Venmo app, nonprofits can customize their marketing settings to improve their charity’s visibility. This feature allows organizations to appear prominently in various parts of the app, like search results, user feeds, and Venmo-generated emails.

Such visibility is strategic for reaching potential donors within Venmo’s user base, effectively highlighting the charity’s mission and funding needs.

This tailored approach in the app’s ecosystem can significantly expand a nonprofit’s donor outreach, leveraging Venmo’s widespread usage for charitable visibility and engagement

Pros and Cons

Pros:

- Immediate Transfers: Venmo enables instant financial transactions, allowing nonprofits to access funds quickly after receiving donations.

- Social Engagement: Venmo’s social feed feature can increase the virality of donations, encouraging more users to contribute when they see friends donating.

- Financial Tracking: Venmo provides an easy way to track donations and manage finances, offering a clear record of transactions for accounting purposes.

Cons:

- Public Transaction Data: Venmo’s social nature might expose donation activity, potentially raising privacy concerns for donors and nonprofits.

- Limited International Use: Venmo is primarily used within the United States, which could limit fundraising opportunities from international donors.

- Dependency on Platform Stability: Relying on Venmo necessitates trust in its digital infrastructure and ongoing service availability, posing a risk if the platform experiences downtime or changes its policies.

Venmo offers significant advantages for nonprofits aiming to connect with a tech-savvy audience, capitalizing on its user-friendly interface, cost-effectiveness, and extensive user base.

While there are some drawbacks, such as potential security concerns and the informal nature of transactions, the platform remains a valuable asset in the arsenal of contemporary fundraising tactics.

Nonprofits can harness Venmo’s popular appeal and convenience to facilitate donations, making it a compelling choice for enhancing donor engagement and streamlining the giving process in the digital age.